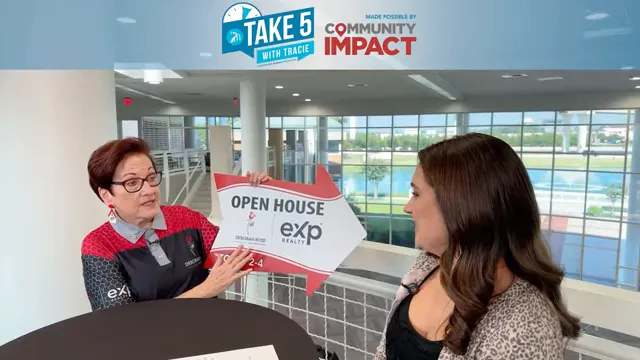

Take 5 With Tracie featuring Deborah Rose Miller of Deborah Rose Realty Group powered by eXp

Take 5 With Tracie featuring Deborah Rose Miller of Deborah Rose Realty Group powered by eXp

I'm Tracie, and in this short episode produced by the Greater EMC Chamber I sat down with Deborah Rose Miller of Deborah Rose Realty Group powered by eXp to talk branding, connection, and what’s happening in real estate right now. Deborah is energetic, intentional about her brand, and optimistic about how creativity and resources will shape the months ahead.

How Deborah built a memorable brand

Deborah’s brand grew out of something personal: her maiden name, Rose. Before real estate she ran Rose Financial Group, and the rose motif has followed her through four careers. The consistency of that visual and name recognition is what makes her easy to remember—clients often call her “Rose” and she lets it stick.

"My brand is working so it's good. It's a compliment." — Deborah Rose Miller

Key branding takeaways from Deborah’s approach:

- Use a personal, consistent symbol or name across careers and materials.

- Make your brand visible on signage, apparel, and magnets so it becomes familiar.

- Lean into what people use to remember you—if they call you “Rose,” that recognition is working.

Staying connected: chambers and leadership

Deborah has been self-employed since her twenties and has consistently used local chambers and leadership programs to market herself and build a deep network. For her, being involved is about staying relevant to people's needs—both financial and real estate—and knowing the contacts she references.

Why this matters:

- Chambers and leadership programs expand your referral network.

- Active community involvement helps you stay informed about local priorities and opportunities.

- Knowing people personally makes your recommendations and referrals more credible.

What’s happening in the market: a market of disruption

Deborah calls the current climate “a market of disruption.” Here are the highlights she shared with me:

- Roughly 60% of the marketplace is sitting on mortgages at about 4% or below. That creates a motivation gap—many homeowners are reluctant to move because they’d lose those attractive rates.

- Assumptions are becoming part of the conversation. VA and FHA loans can be easier to assume in some cases, while conventional loans generally are not eligible for assumption.

- Lenders are getting creative within product rules, offering different pathways for buyers and sellers to make moves that make sense financially and logistically.

"Resources and creativity are going to be the stronghold moving forward." — Deborah Rose Miller

Why buyers should consider acting now

Deborah believes the current level of inventory makes this a strong time for buyers to act rather than wait. A couple of practical points she emphasized:

- Interest rates will change, but if you take advantage of today's rates you can often refinance later—many lenders are waiving refinance costs to make that path more attractive.

- High inventory means buyers have choices and negotiating power now; waiting risks losing that control if inventory tightens later.

One surprising stat she mentioned: a large portion of lenders (the bulk, around 90%) are waiving refinancing costs in many scenarios—something that can change the calculus for buyers and sellers who plan ahead.

Practical advice I heard and want to share

- If you’re buying: consider moving forward while inventory is high and lenders are offering flexible options—plan for a refinance later if rates improve.

- If you’re selling: understand your buyers’ motivations—many will be hesitant if they have low mortgage rates—so focus on how you can offset or justify a move.

- Work with agents and lenders who are creative and up-to-date on assumption and loan-product possibilities for VA/FHA and other programs.

Wrap-up and next steps

I enjoyed this conversation with Deborah because she blends timeless marketing fundamentals—consistent branding and strong community ties—with a forward-looking read on financing and market mechanics. If you want to stay informed about local opportunities and market insights, check out Community Impact’s Morning Impact at communityimpact.com and follow the Greater EMC Chamber on social media.

Thanks for taking five with me. Keep adding value and making a difference.

— Tracie